EUR/USD comes under pressure near 0.9900 post-PMIs

- EUR/USD’s upside momentum falters just ahead of 0.9900.

- The dollar attempts a moderate recovery at the beginning of the week.

- Flash Manufacturing and Services PMIs take centre stage.

The single currency comes under some mild downside pressure and drags EUR/USD to the 0.9820 region on Monday.

EUR/USD looks to PMIs, risk appetite

EUR/USD now faces selling pressure and gives away some ground following two consecutive daily advances on the back of the mild recovery in the dollar despite the move lower in US yields.

Still around the debt markets, the German 10-year bund yields drop to 3-day lows and approach the 2.30% zone after climbing as high as the 2.53% at the end of last week.

Moving forward, the pair is expected to remain within a consolidative mood ahead of the ECB event on Thursday, when markets participants largely anticipate a 75 bps rate hike by the central bank.

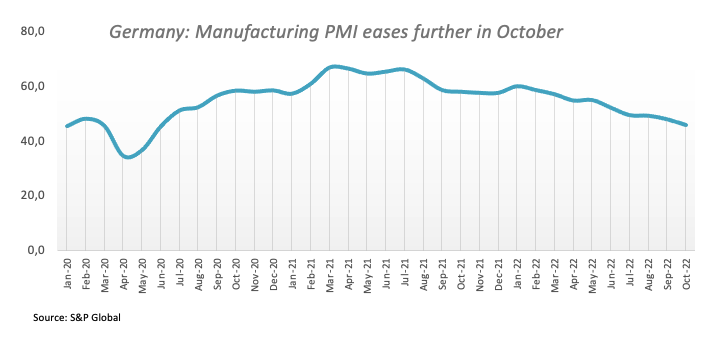

In the domestic calendar, the flash Manufacturing PMI for the current month is expected to ease to 47.4 in France, 45.7 in Germany and 46.6 in the broader Euroland.

In the US, advanced PMIs are also due along with the Chicago Fed National Activity Index.

What to look for around EUR

EUR/USD now faces some corrective decline, although it so far manages well to keep the trade above the 0.9800 mark for the time being.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Following latest results from key economic indicators, the latter is expected to extend further amidst the ongoing resilience of the US economy.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: German, EMU Advanced Manufacturing/Services PMIs (Monday) – Germany IFO Business Climate (Tuesday) – France Consumer Confidence (Wednesday) - Germany GfK Consumer Confidence, Italy Consumer Confidence, ECB Interest Rate Decision, ECB Lagarde (Thursday) – France/Italy/Germany Flash Inflation Rate, Germany Preliminary Q3 GDP Growth Rate, EMU Final Consumer Confidence, Economic Sentiment

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.25% at 0.9832 and the breakdown of 0.9631 (monthly low October 13) would target 0.9535 (2022 low September 28) en route to 0.9411 (weekly low June 17 2002). On the flip side, the next up barrier comes at 0.9899 (weekly high October 24) followed by 0.9999 (monthly high October 4) and finally 1.0050 (weekly high September 20).