AUD/JPY Price Analysis: Multiple resistances to cap bounce off 61.8% Fibonacci

- AUD/JPY holds onto recovery gains despite bearish MACD.

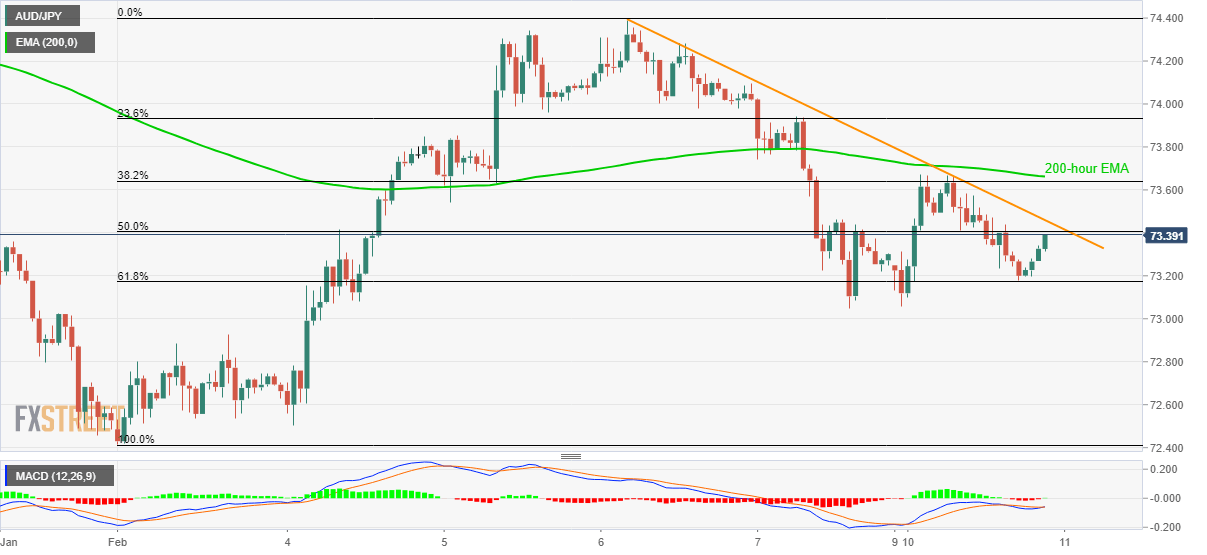

- A three-day-old falling trend line, 200-hour EMA will question immediate upside.

- 73.00 holds the key to the further downside below 61.8% Fibonacci.

AUD/JPY stays mildly positive while taking rounds to 73.35 during the early hours of Tuesday’s Asian session. The pair recently managed to reverse from 61.8% Fibonacci retracement of its January 02-06 upside. However, bearish MACD signals and multiple upside barriers will check the pair’s recovery.

Among the resistances, 50% Fibonacci retracement level of 73.40 and a descending trend line from February 06, at 73.45, will be the immediate ones to watch.

Apart from 73.45, a confluence of 200-hour EMA and 38.2% Fibonacci retracement around 73.65/70 will also challenge the buyers.

In a case where AUD/JPY prices stay positive beyond 73.70, 74.00 and the monthly top surrounding 74.40 will be in the spotlight.

On the downside break of 61.8% Fibonacci retracement, at 73.15, the quote can take rest around 73.00 before revisiting 72.80 and the last week’s bottom close to 72.40.

AUD/JPY hourly chart

Trend: Bearish