Back

19 Feb 2020

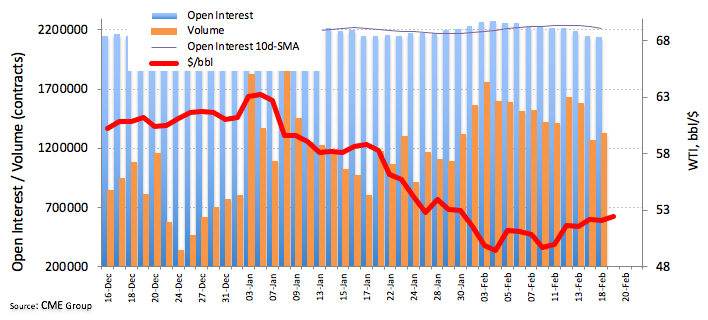

Crude Oil Futures: Upside remains limited

CME Group’s advanced figures for Crude Oil futures markets showed traders scaled back their pen interest positions for the sixth session in a row on Tuesday, this time by around 1.3K contracts. On the other hand, volume reversed two consecutive daily drops and increased by around 54.7K contracts.

WTI points to further consolidation

Tuesday’s test and rebound from sub-$50.00 levels in WTI was accompanied by another pullback in open interest. The persistent downtrend in open interest leaves occasional bullish attempts somewhat limited for the time being, or until the dust finally settles around the OPEC+ negotiations to extend further the output cur deal and to implement deeper cuts.